Custom Technology Solutions

Professional Services

Empower your business with Integritek’s professional services, a white-glove experience from beginning to end. Whether you require network enhancements or a smooth transition to the cloud, our team of seasoned project engineers are ready to collaborate with you to craft and deploy tailored-made IT solutions that will help you save money and stay ahead of the curve.

Features & Benefits

Comprehensive IT Project Services

Navigating a complex technology deployment may seem daunting, but rest assured, our dedicated team of project engineers are here to help bring your vision to life. We will partner with you to understand your business objectives, design a tailored solution that aligns with your needs, and seamlessly put that plan into action, ensuring your business operates at its best.

Cloud Migration

- Access your data and applications anywhere, anytime

- Easily scale resources based on your need

- Reduce the need for expensive on-premise technology

Infrastructure Modernization

- Replace outdated hardware and software

- Improve performance, reliability, and security

- Future-proof your IT infrastructure

Application Integration

- Seamlessly connect and automate business processes

- Reduce manual errors and delays

- Improve overall business agility and responsiveness

Data Management

- Optimize data storage, backup, and recovery

- Ensure critical data is secure and readily accessible

- Gain better insights and value from your data

Network Optimization

- Improve network performance, speed, and security

- Identify and resolve network issues and vulnerabilities

- Enhance user experience and satisfaction

Expansion & Relocation

- Plan, design, and implement IT expansion strategies

- Support business growth and scalability

- Ensure smooth and secure integration of new locations

Achieving Your Potential through Professional Services

Discover, Design, DeployA successful project is like a well-orchestrated symphony, where meticulous preparation and harmonious execution come together to deliver exceptional results.

At Integritek, this journey starts with a collaborative discovery process, where we actively engage with your team to understand your unique challenges and vision. Our team of experts then design innovative solutions that match the tempo of your business. With our goals aligned, we partner with you to bring that vision to reality and seamlessly deploy these new technologies into your organization.

You don’t have to face the ever-evolving landscape of technological change alone. Our project engineers are ready to help orchestrate your success with solutions that help you save money and time while giving you the peace of mind that your technology is secure.

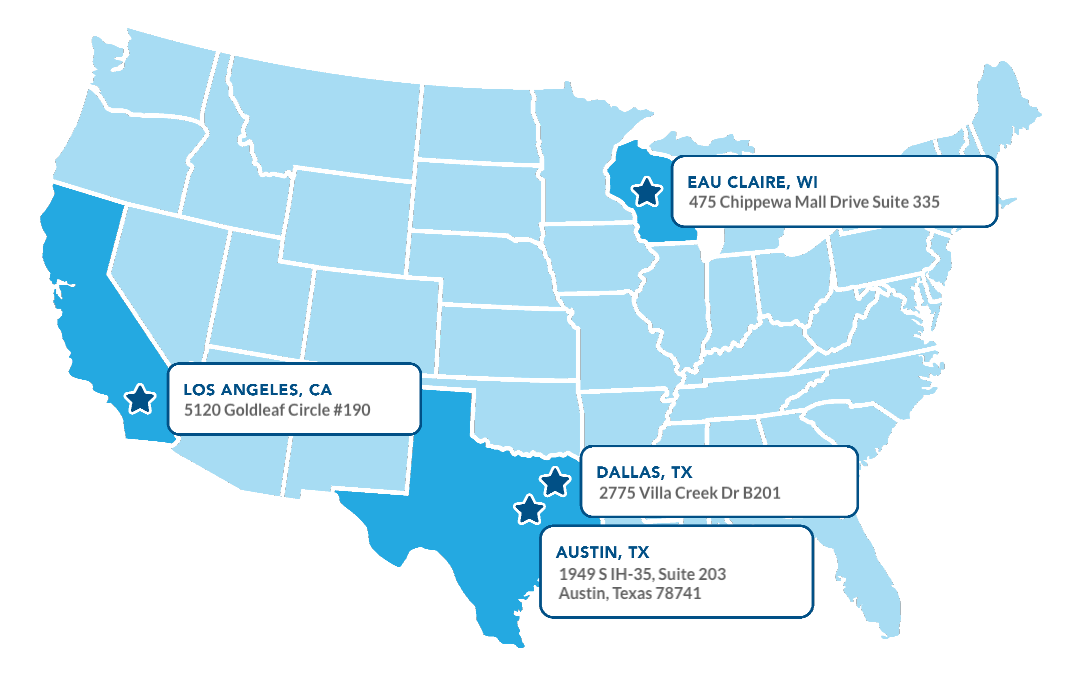

Local Support with Nationwide Coverage

No matter the stack—we’ve got you covered

Reserve Your

Free Dark Web AssessmentFor a complimentary, no-obligation examination of your network’s security and overall health get in touch and a member of our team will be in touch.

Get a quote for our services sent into your inbox